The finance industry is a dynamic one that is always changing and expanding. The need for certified accounting specialists in both public and private companies is growing as a result of this expansion. Employing managers are actively looking for applicants who hold the esteemed Certified Public Accountant (CPA) certification in addition to professional experience.

What we will cover?

What Does the Market Demand?

Obtaining your CPA credential puts you in an executive role in a company, setting you up for career advancement and a large pay increase. Research suggests a significant pay increase: a CPA can raise a staff accountant’s median income to $68,517, which is an increase of 25%.

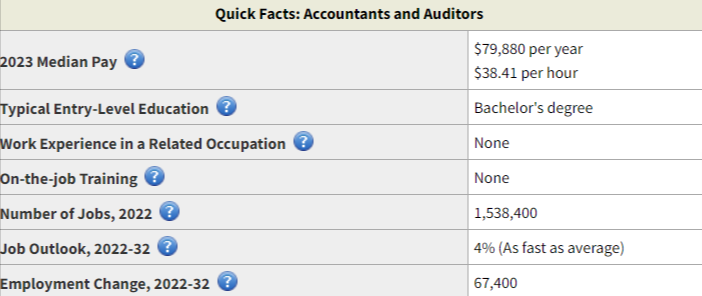

There are reasons behind this increase. First off, there is a sound job market. Over the next decade, the Bureau of Labor Statistics predicts that the demand for accountants and auditors will grow by 4%. This corresponds to an estimated 57,444 new job opportunities annually.

Moreover, accounting firms expect to employ graduates in the upcoming years. Yet, their executives have difficulty finding suitable applicants. There is an even greater need for qualified and certified CPAs when you consider the approaching wave of Baby Boomer retirements.

Source: https://www.bls.gov/ooh/business-and-financial/accountants-and-auditors.htm

The Benefits of Becoming a CPA

Becoming a CPA might be the best option for you if you’re someone who loves the complexities of numbers, has a good eye for detail, and thrives on problem-solving. Numerous opportunities are unlocked with the CPA title. In this part, we’ll explore the reasons why pursuing a career as a CPA could be ideal for you!

Lucrative Career Path

The significant rise in earning potential that a CPA provides should not be undervalued. Exam passers are often rewarded with bonuses from public accounting firms, which can range from $2,000 to $5,000. This is a nice way to say thank you for your hard work.

However, your long-term earning potential is where the true financial benefit is found. Over the course of a 40-year career, CPAs can expect to gain over $1 million more compared to their non-CPA counterparts and have the potential to move up on the corporate career ladder.

Moreover, the accountant’s position is sustainable. While some simple calculations may be automated by AI advancements, this frees up CPAs to concentrate on more strategic tasks like investment analysis and offering insightful financial advice.

You Can Become One Without An Accountancy Degree

The CPA exam is open to those with degrees in business management, economics, or finance. They must, however, complete particular course requirements in order to guarantee that they have a solid foundation in accounting principles.

There are several ways to accomplish this, such as enrolling in additional graduate or undergraduate accounting courses, obtaining a certificate program, or even becoming certified by organizations that represent professional accountants, such as the ACCA or CIMA.

Becoming a CPA is a fantastic option for those looking to change careers or pursue a fulfilling new path because they are frequently offered part-time or even entirely online. The appeal is in the adaptability. You can adapt your strategy to suit your upbringing life.

Place and Time Flexibility

There is a universal need for accounting expertise, unlike many professions where moving to a large city is often necessary. This frees CPAs from severe restrictions on the job market to pursue their aspirations in their hometowns.

Additionally, there is a lot of technical flexibility available in accounting. Accountants have a variety of work environments to choose from, including traditional office spaces, working remotely, or using their experience as independent consultants.

ConvergenceCoaching® found that 94% of accounting firms currently offer flexible work schedules. With the great majority of companies allowing employees to work remotely, even just partially, this trend mirrors the industry’s shift towards remote work models.

Is The CPA Exam Worth Doing?

Given the difficulty of the CPA exam, you may be wondering if it’s worth the time and effort. To put it briefly, there are a lot of reasons why passing it is highly desired by employers and why taking it is a wise investment in your future.

First of all, there is much more to studying for the CPA Exam than just learning and remembering facts. It’s a thorough exploration of the nuances of accounting that serves as a demanding environment for you to hone your accounting skills.

When you diligently read through the study materials, you’ll probably come across new aspects of accounting that you were unaware of before. Your technical skill set will be strengthened and your overall financial literacy will be solidified by this comprehensive preparation.

More significantly, you will acquire a better comprehension of how these ideas relate to actual situations as you work to mentally recall those concepts and use them to practice problems in the test setting. Needless to say, employers prefer this.

Developing an analytical business mindset can also be facilitated by studying intricate calculations and financial processes. By exposing you to new ways of thinking, this angle helps you see financial situations through a more strategic and incisive lens.

In addition to demonstrating your accounting comprehension, passing the CPA Exam expands the number of opportunities available to you. Your certification is a critical differentiator because some employers may reject applicants who are not licensed CPAs.

Not to mention, passing the CPA Exam requires a great deal of hard work and dedication, which pays off in a profound sense of personal fulfillment. The accomplishment of such a difficult objective fosters a strong sense of self-confidence.

In addition to earning a credential, a lot of test takers say that passing the CPA Exam and the preparation process had been rewarding for them. Beyond the exam room, the journey cultivates a sense of personal growth and accomplishment.

To sum up, taking the CPA Exam can lead to a variety of benefits for your career. From improved knowledge and abilities to more extensive career options, the benefits of becoming a CPA far outweigh the difficulties of passing the exam.

The Takeaway

Although becoming a CPA is a path that demands commitment and concentration, the benefits are definitely alluring. Many businesses provide enticing incentives, such as above-average compensation packages that may include perks like extra vacation days, flexible work schedules, and even CPA exam bonuses, in an effort to entice the best candidates.

Review Summary

User Reviews

There are no reviews yet. Be the first one to write one.

Share Your Experience